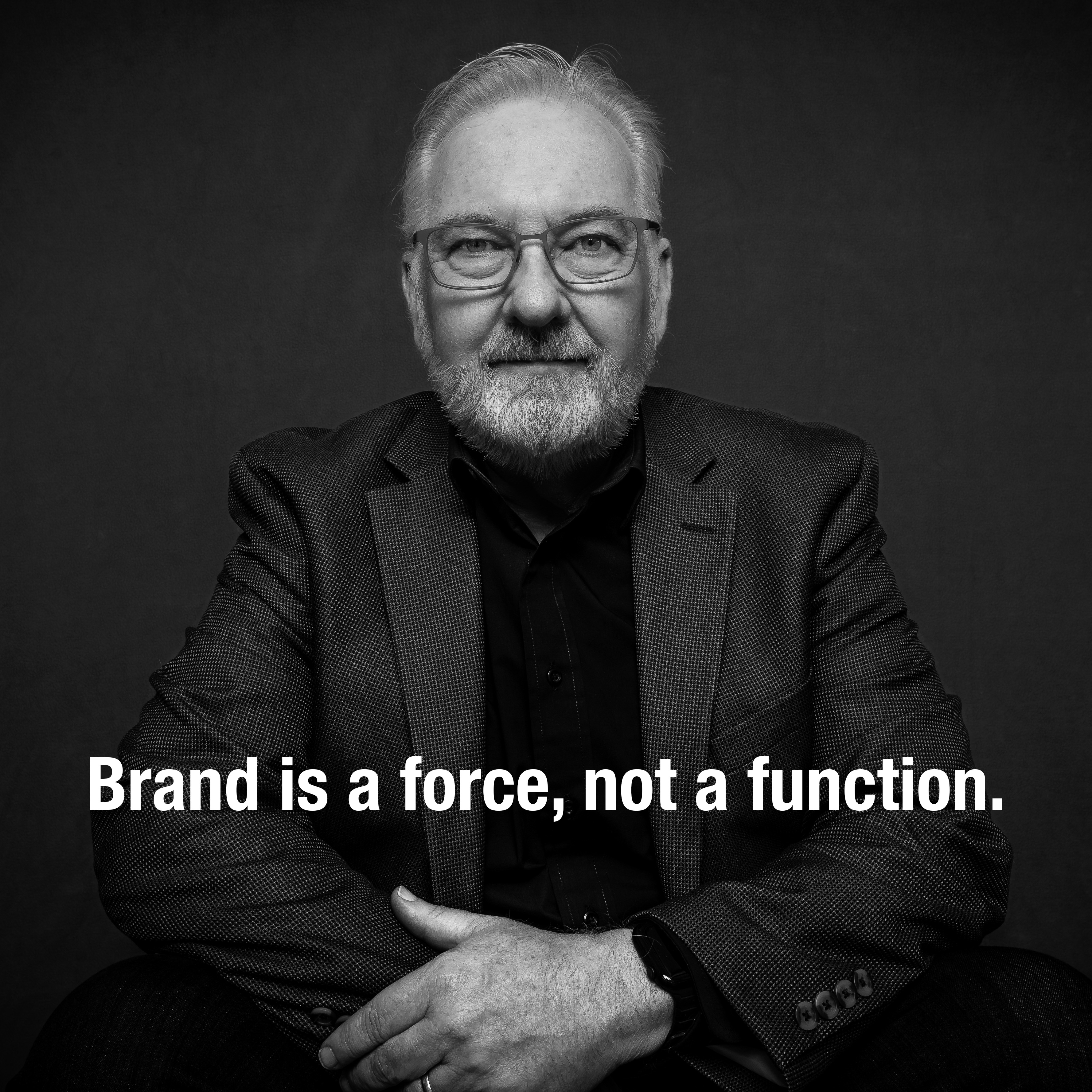

Bill Chidley has spent more than forty years helping brands find their center of gravity.

His career has moved between creativity and strategy, first leading design and creative teams that shaped how brands look and feel, and later serving as a strategist focused on how brands work and grow.

As Vice President of Strategy at Interbrand, he contributed to the Best Global Brands valuation and helped shape the modern understanding of brand as a driver of business value.

Today, Bill is the Executive Director of Strategy and co-founder of ChangeUp, a branding and experience design firm that works with clients such as Burger King, BP, Subway, Discount Tire, Baskin Robbins, and Subaru to bring their brands to life through experiences that pull people in and keep them coming back.

Over his career, he has also partnered with companies including Procter & Gamble, McDonald’s, Honda, AT&T, Dunkin’, Intel, and John Deere, helping them translate business goals into meaning people can feel.

His book The Brand Vortex is the culmination of that journey. It unites creativity and behavioral science into a single theory of how brands gain gravity, grow with coherence, and earn a place in people’s lives.

"After four decades shaping some of the world’s most enduring brands I've learned that Brand isn’t persuasion. It’s gravity, the quiet force that moves belief, behavior, and belonging."

Bill Chidley, ChangeUp

Praise for The Brand Vortex:

"A comprehensive guide to elevating your branding game."

"The author’s long experience shows on every page of his book, which is full of challenging reconceptions of the nature and psychology of branding."

"An involving and thought-provoking series of challenges to the old-fashioned idea of brand building."

Kirkus Reviews, January 9, 2026.

Available on Amazon

The Brand Vortex is for two kinds of people:

Those who believe in brand and want to harness the forces behind it.

Those who sense brand matters but haven’t yet found language for why.

It turns intuition into insight, showing how brands shape behavior, meaning, and belonging not through persuasion, but through pull. Whether you build, lead, or design for a brand, this book gives you a new way to see—and a better way to move people.

Read an Exerpt: